DeFi Development Company

Eager to reinvent your business with innovation? Welcome to the DeFi revolution, where we offer customized, flexible, and budget-friendly DeFi development services. Stay connected with us to lead the way!

Vast Domain Experience

Vast Domain Experience

Highly Expertise DeFi Team

Highly Expertise DeFi Team

Enhanced Security

Enhanced Security

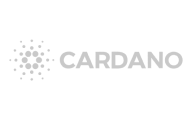

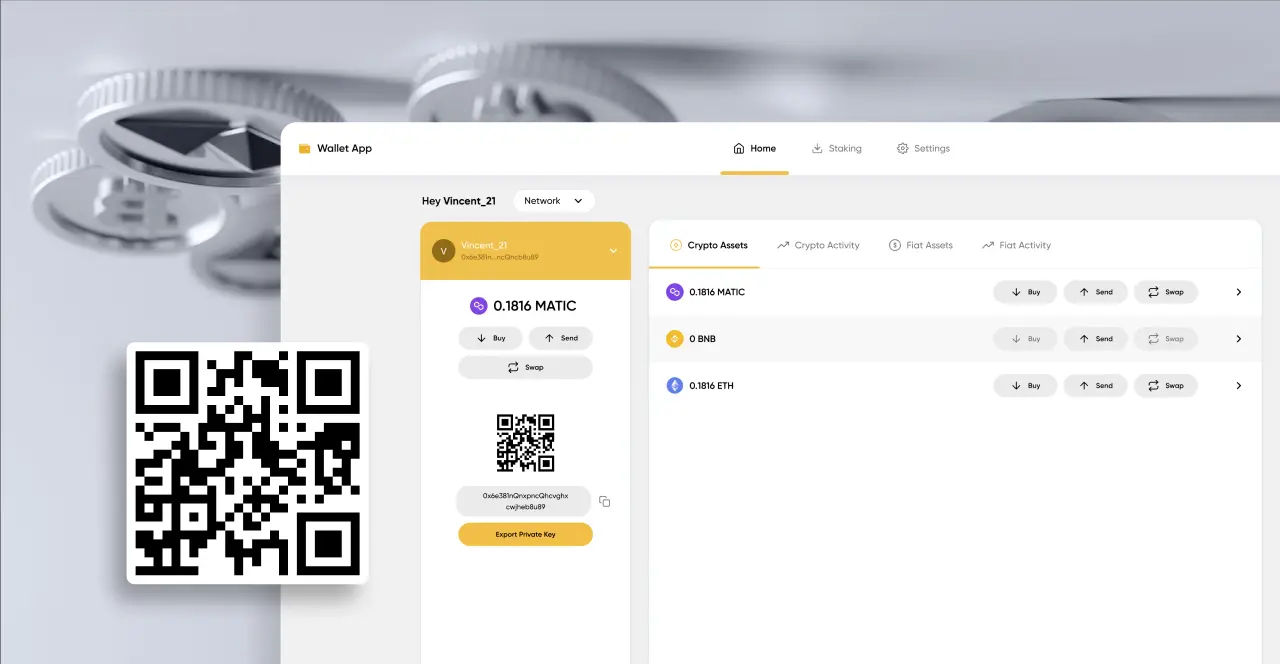

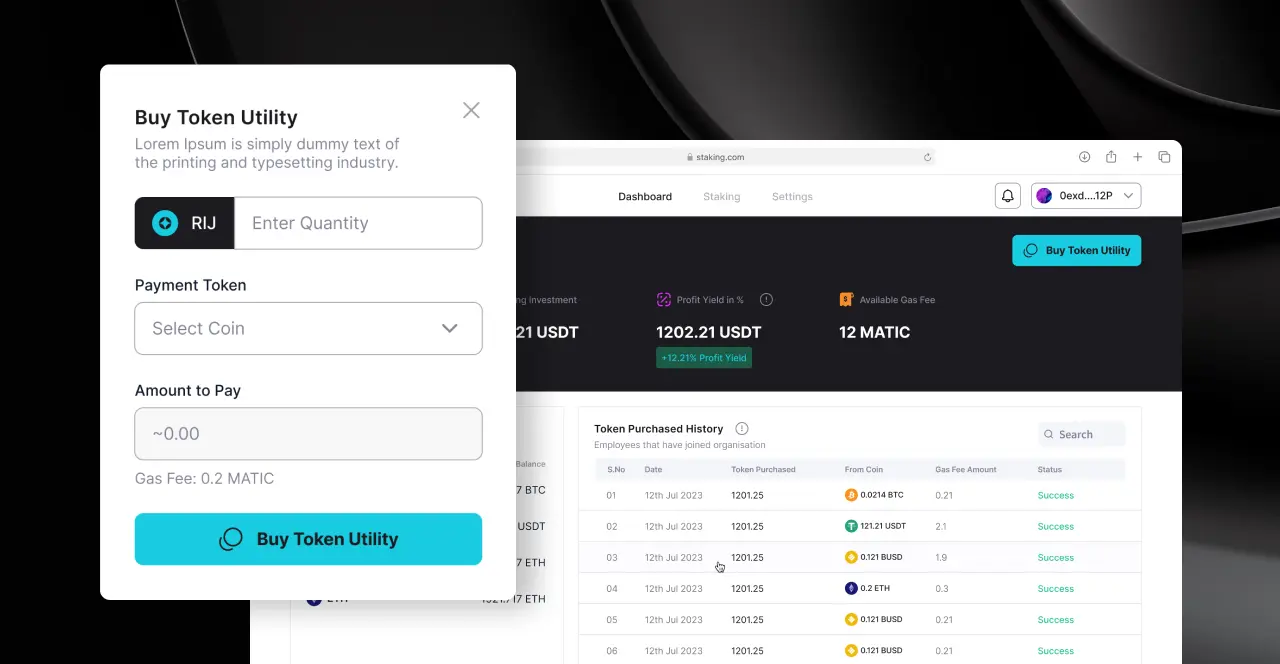

User-friendly Development

User-friendly Development

Contact Us

Contact Us