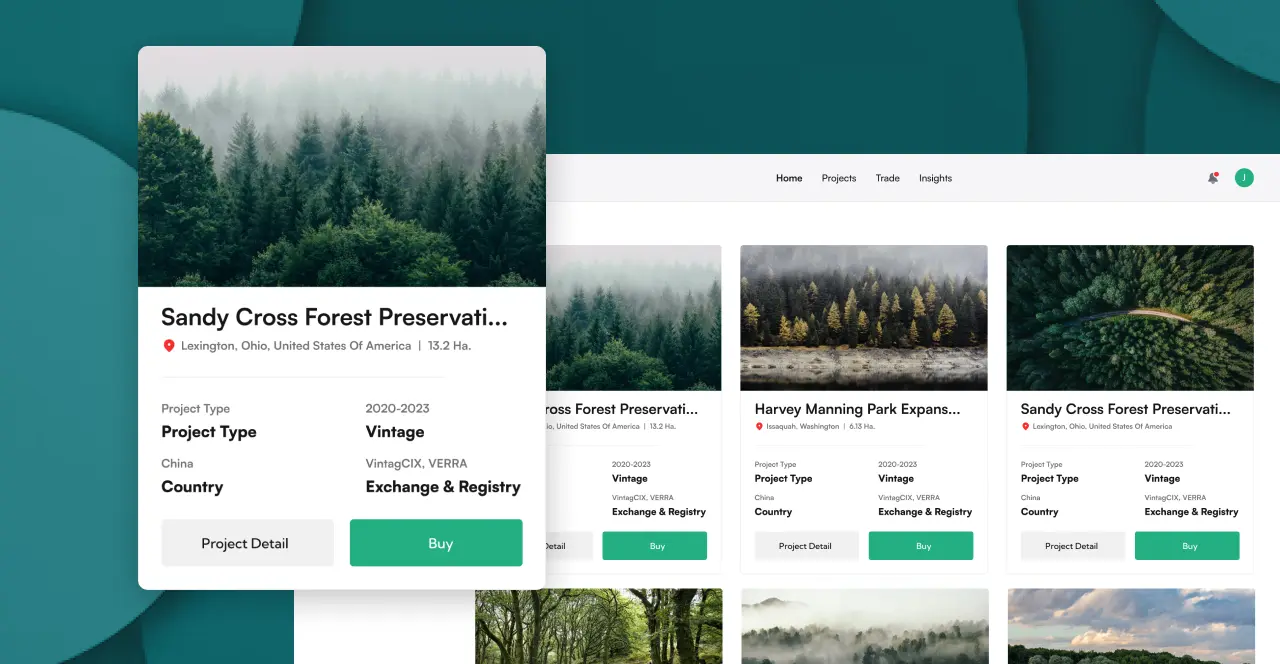

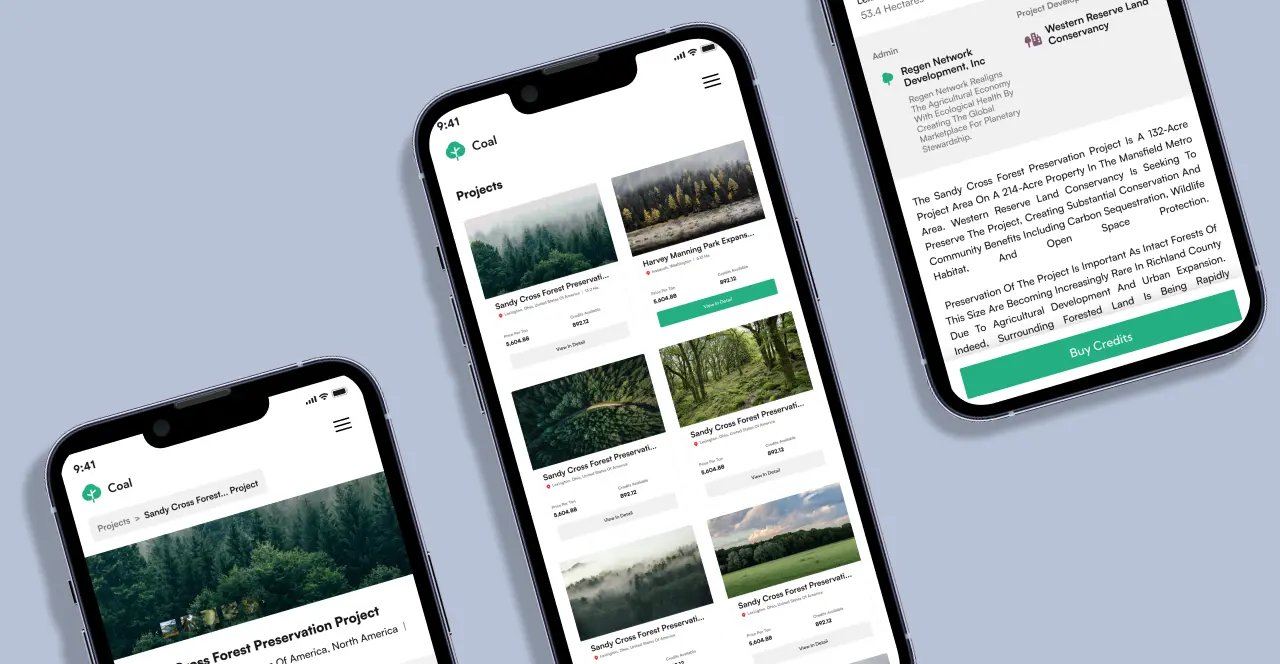

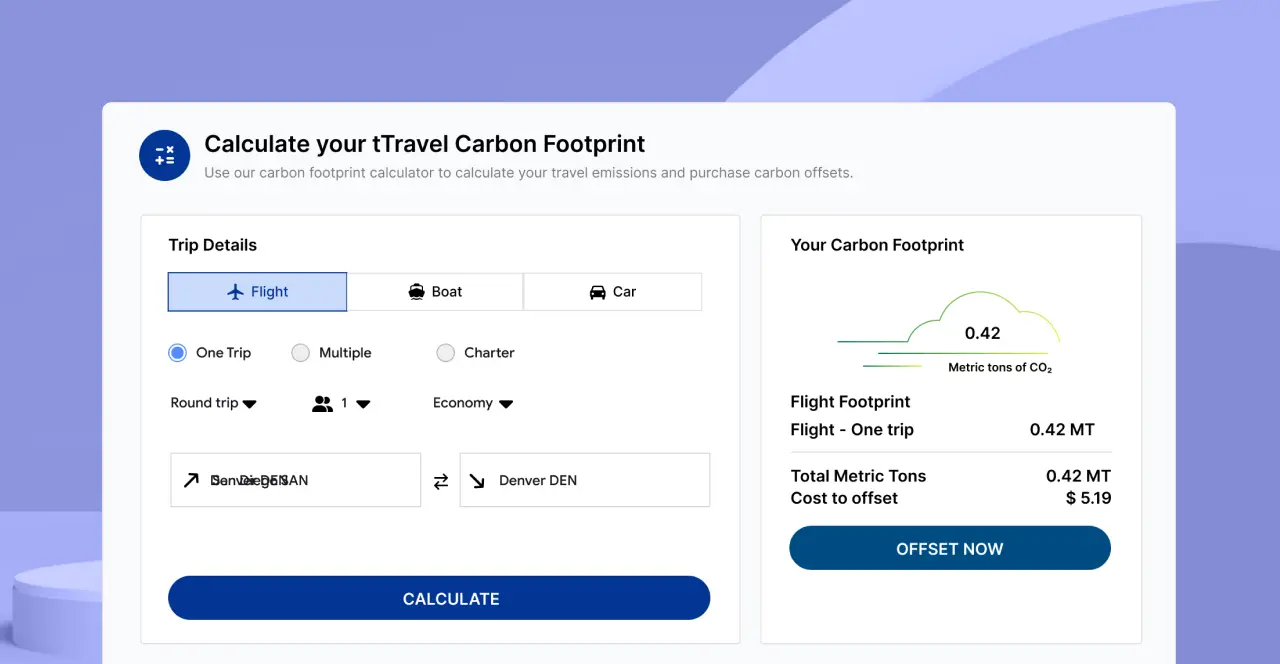

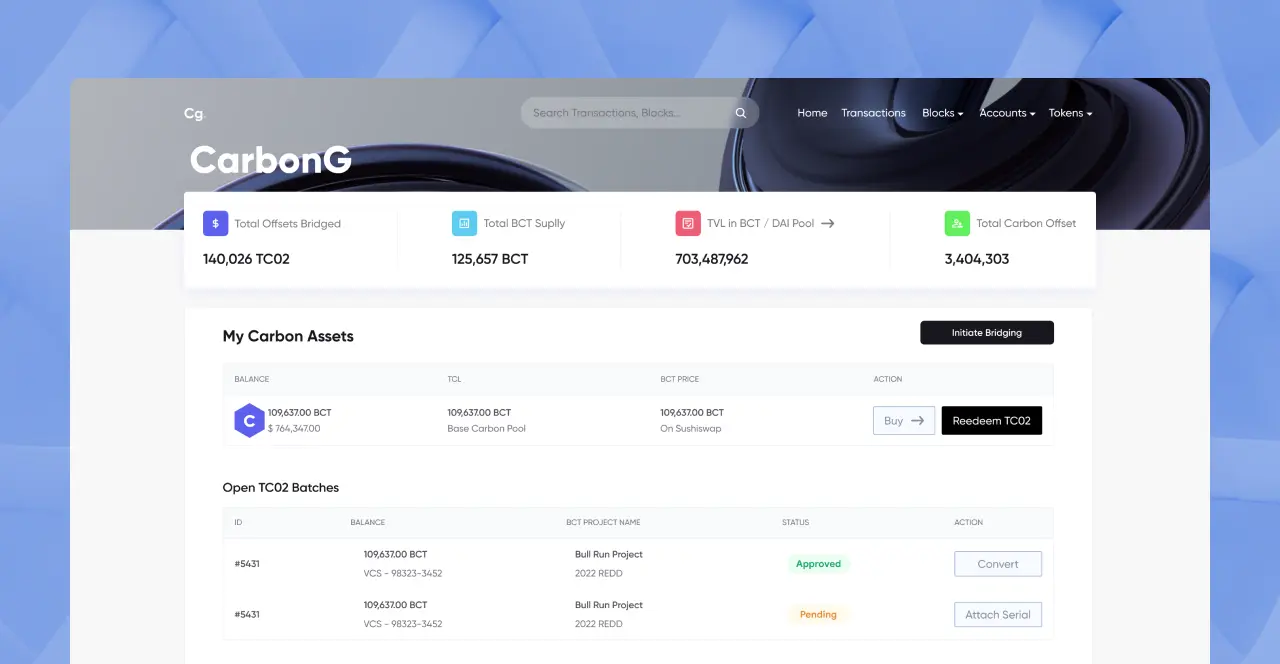

ReFi Development Company

Ready to revolutionize finance with cutting-edge innovation? Say hello to the future of financial ecosystems! Our ReFi Development Services are tailored to empower individuals, enterprises, and communities alike. Elevate your financial landscape with us and embrace the tomorrow!

Vast Domain Experience

Vast Domain Experience

Highly Expertise ReFi Team

Highly Expertise ReFi Team

Enhanced Security

Enhanced Security

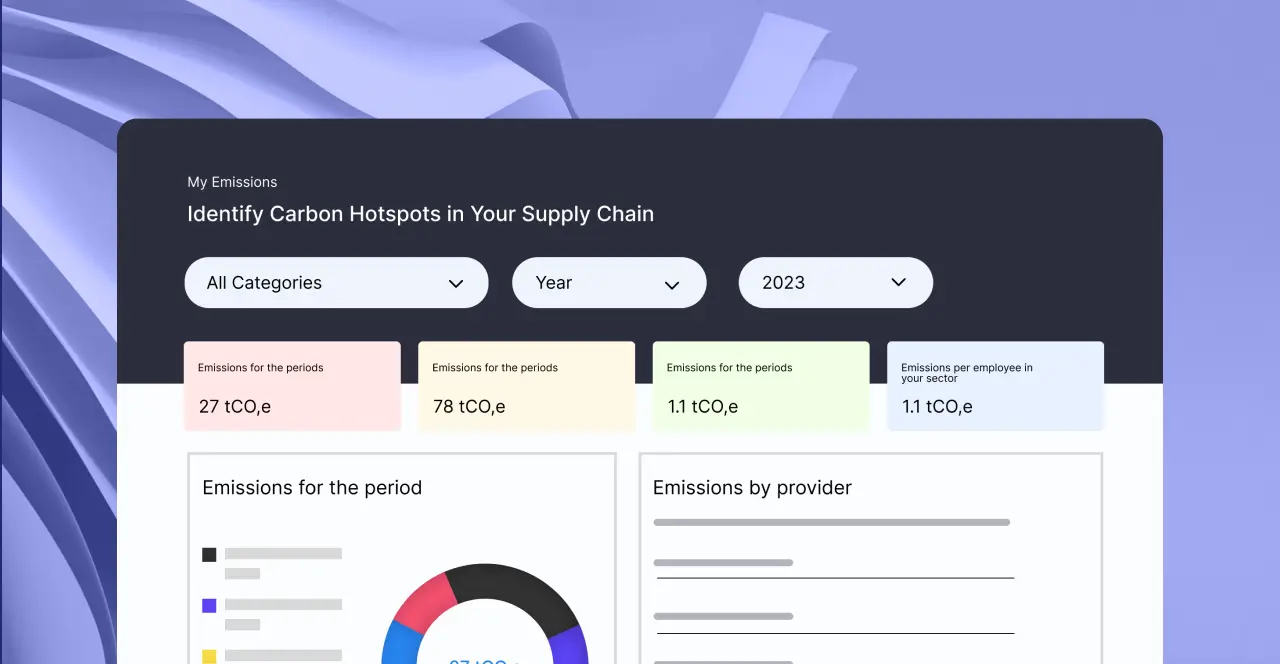

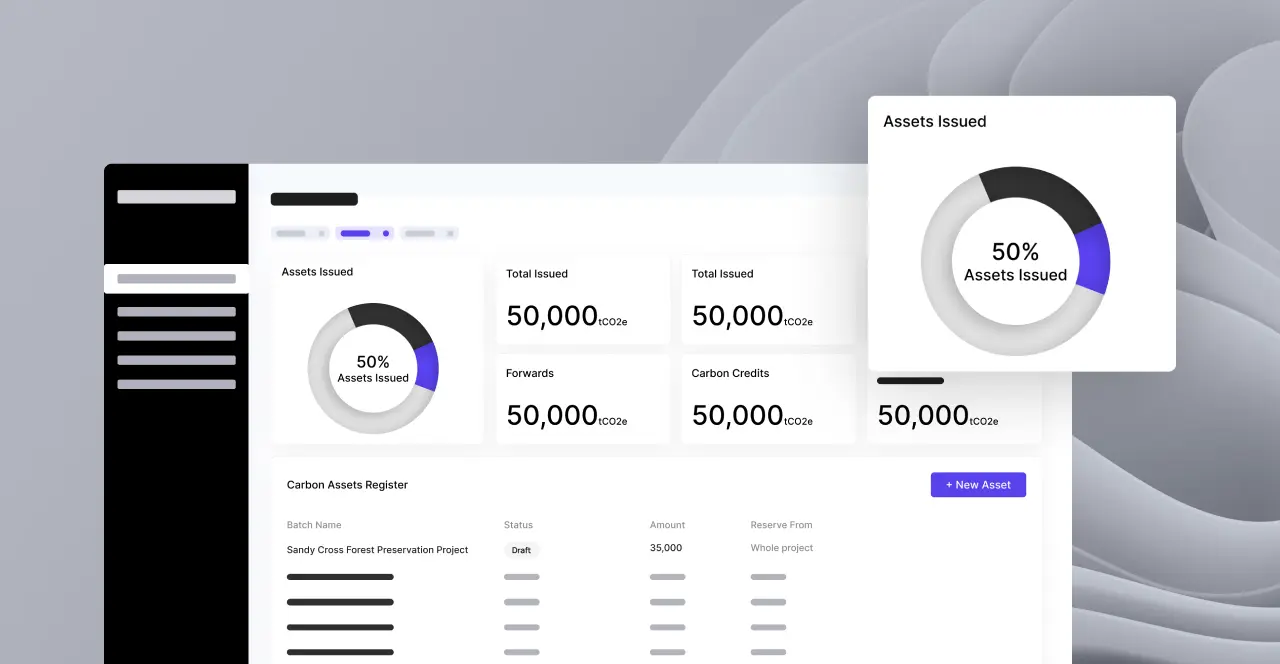

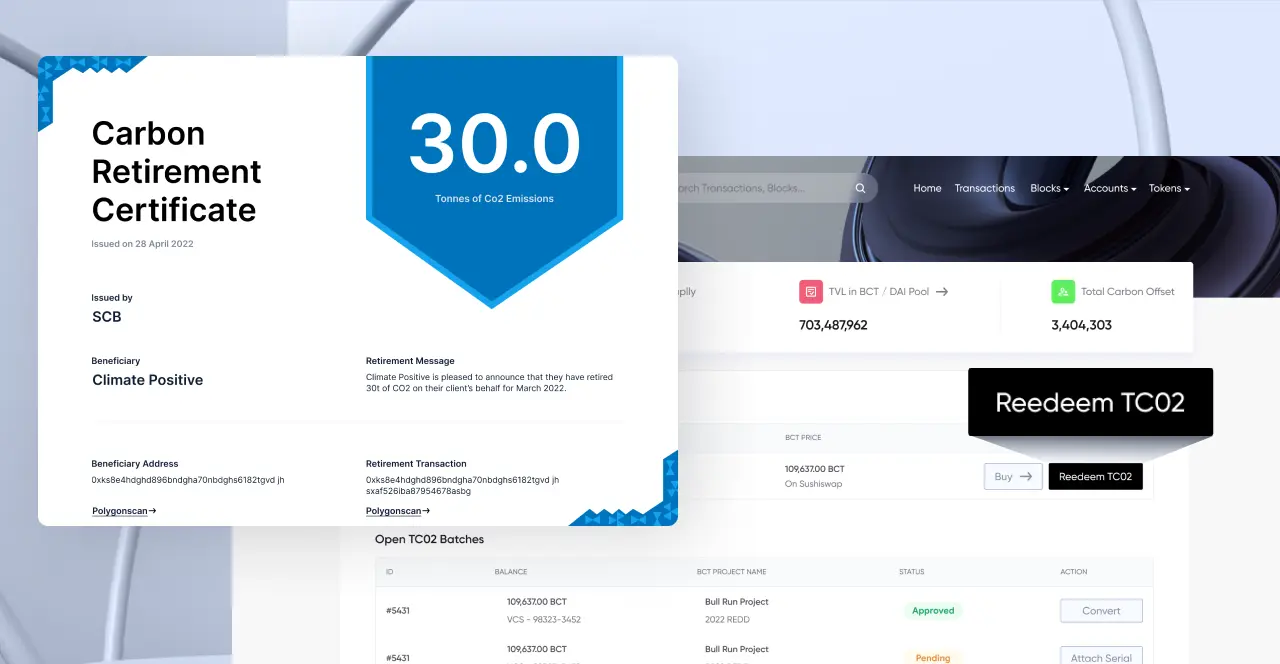

User-friendly Development

User-friendly Development

Contact Us

Contact Us