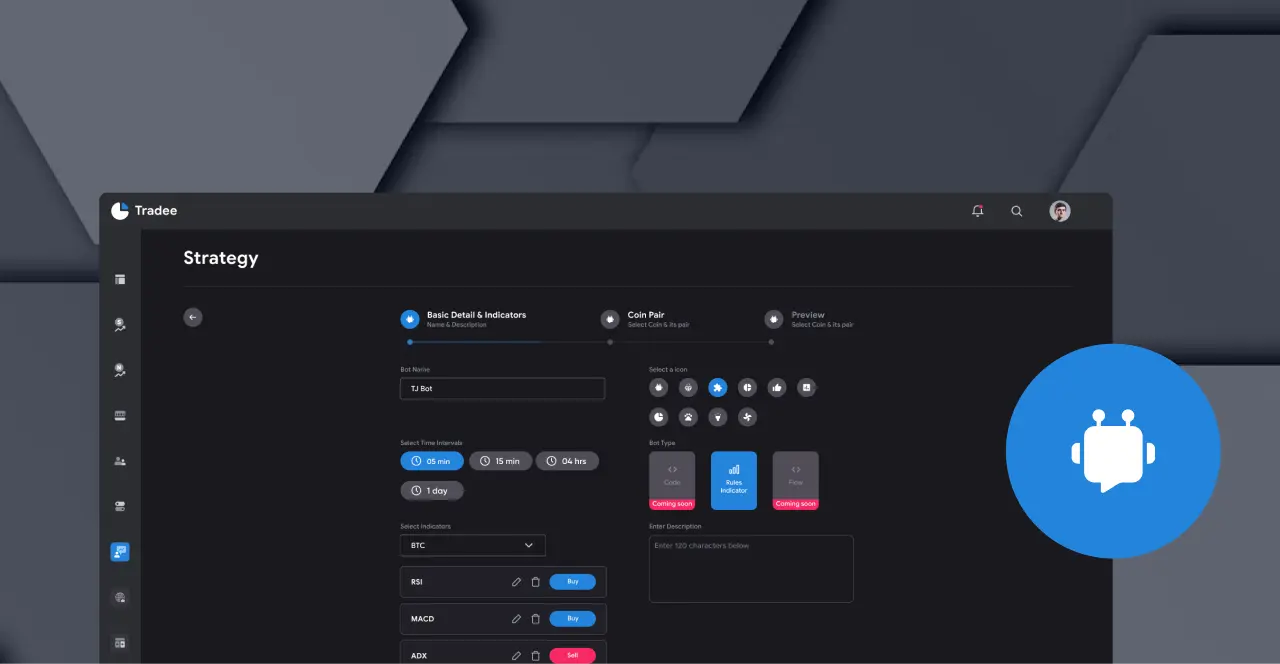

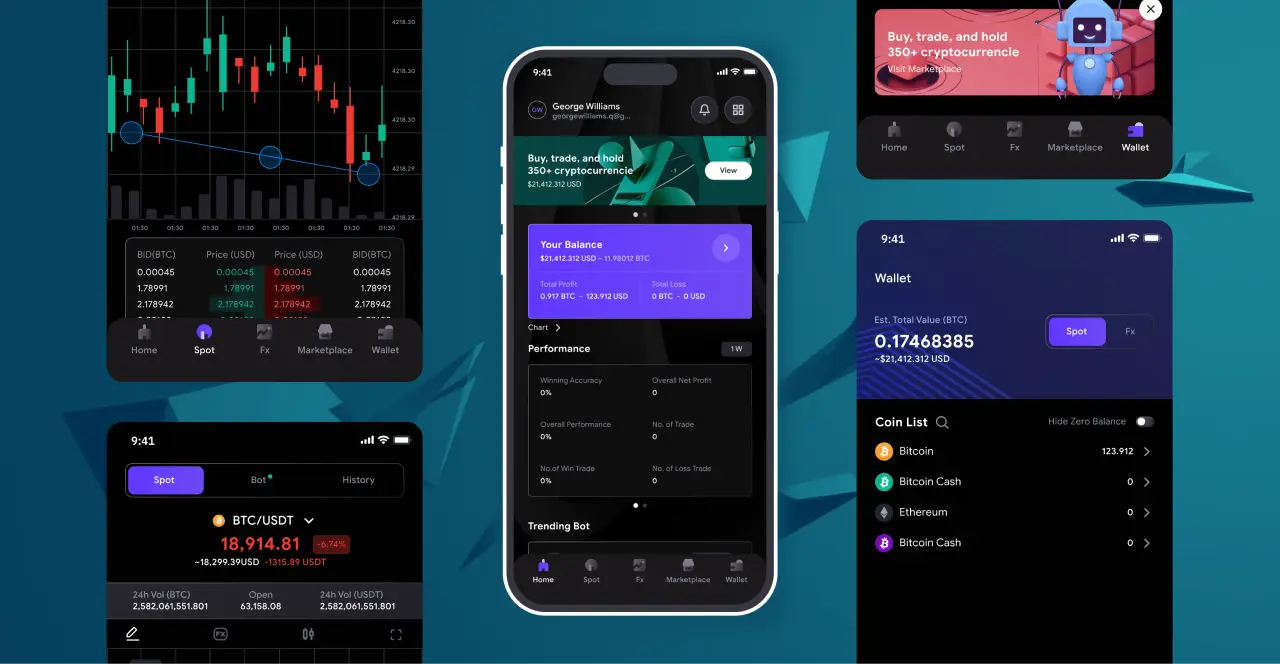

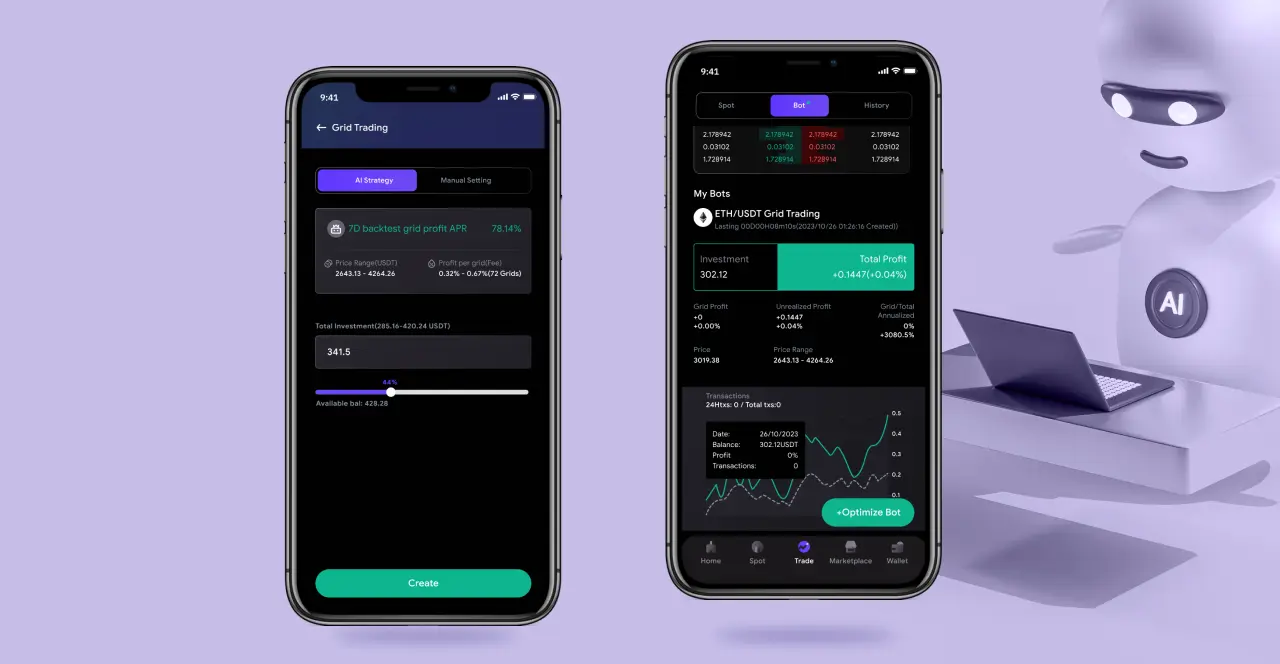

Robotic Process Automation (RPA) Solution

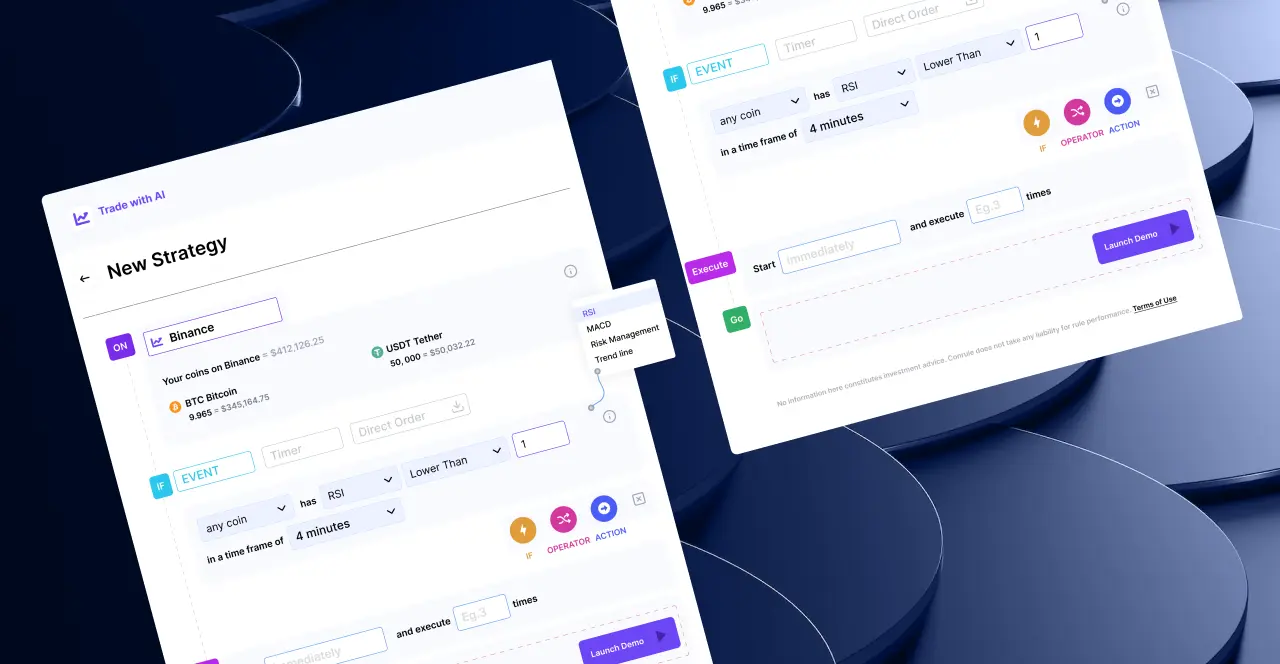

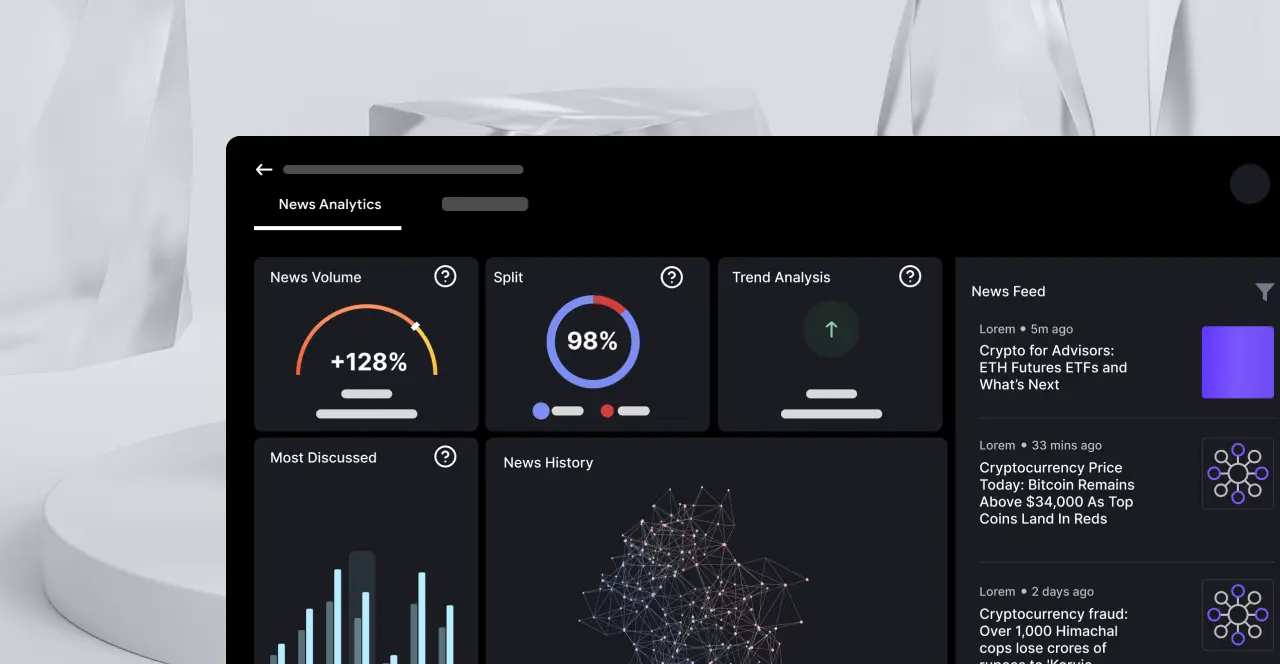

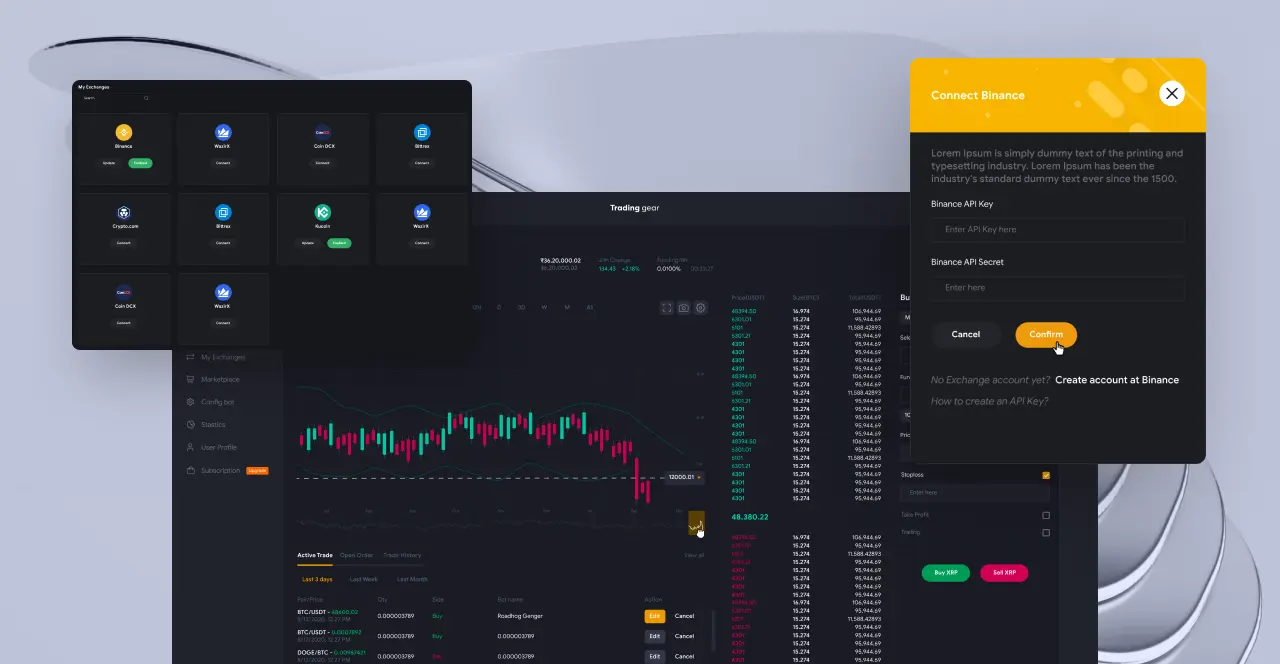

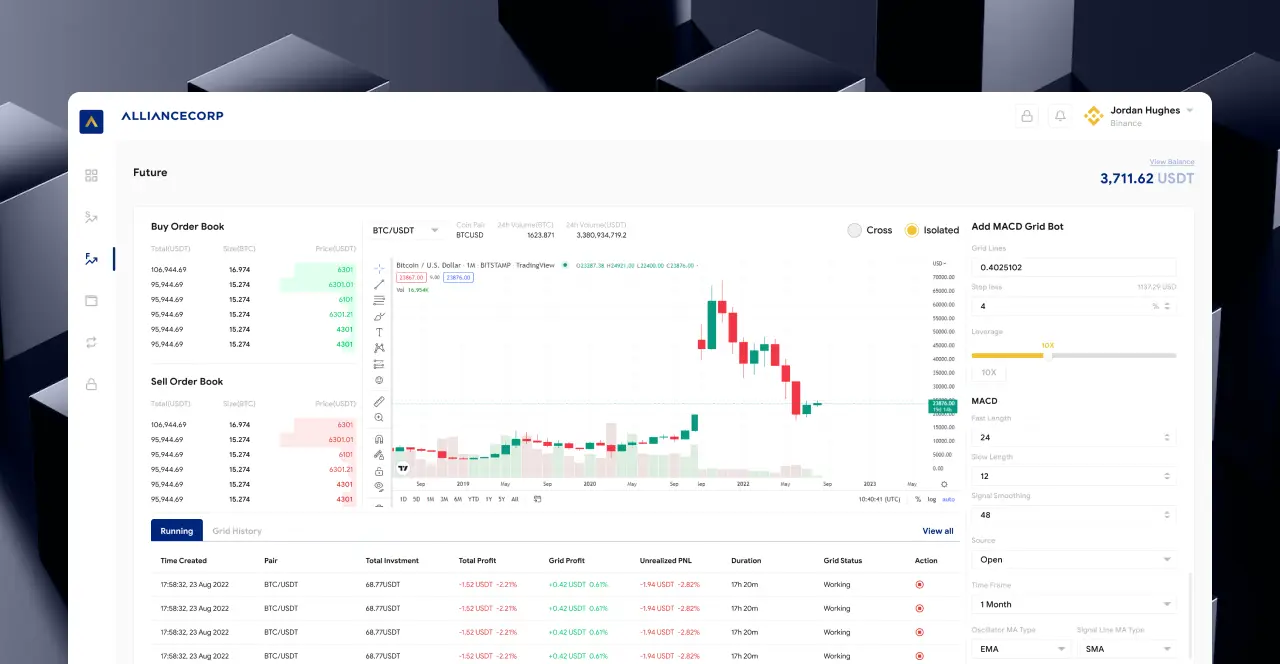

Looking to excel in the trading arena? Your answer is here! We are bringing you the most advanced Robotic Process Automation (RPA) Solution for financial firms, hedge funds, brokers, and individuals. Let’s speed up your trades!

Innovative Custom Trading Solutions

Innovative Custom Trading Solutions

User-Friendly Development

User-Friendly Development

Exceptional Domain Experience

Exceptional Domain Experience

Highly Expertise RPA Developers

Highly Expertise RPA Developers

Contact Us

Contact Us